At a time when ESG criteria (Environmental, Social, Governance) are increasingly being perceived as an integral part of corporate activity, the book “ESG as a driver of M&A” offers a highly topical and practical overview of the role of sustainability in transaction processes. Edited by Karl A. Niggemann, Ulrich Dahlhausen, Markus B. Hofer, Rudolf Schmitz and Oliver Everling, the volume provides both theoretical foundations and valuable insights from corporate practice. It is particularly recommended reading for managers, M&A consultants, investors and ESG managers who are concerned with the sustainable transformation of business models in the context of corporate takeovers and mergers.

Further information on the book published by Springer Gabler-Verlag can be found here.

Download »

In addition to ESG issues (environment, social, governance), the increasing availability and performance of AI (artificial intelligence) is also fundamentally changing the area of M&A activity (mergers & acquisitions). AI technologies make it possible to analyse large volumes of data efficiently, automate processes and make well-founded decisions more quickly. Especially in a dynamic and complex transaction environment, the use of AI offers considerable opportunities to increase efficiency and minimise risk. At the same time, human expertise in strategic, emotional and legal issues remains indispensable.

Download »

The consideration of ESG aspects is a central element of a successful acquisition process. This not only leads to risk minimisation when acquiring a company, but also influences the strategic selection of the target company, integration planning and financing. This article deals with the advantages of taking ESG aspects into account when acquiring companies.

Download »

Sustainability aspects have become increasingly important in society and the economy. Laws such as the EU Taxonomy Regulation, the Corporate Sustainability Reporting Directive (CSRD) and the Supply Chain Duty of Care Act (LkSG) underline the relevance of ESG factors (environment, social, governance) in corporate management. This is a key challenge, particularly in the case of corporate succession. However, forward-looking planning enables sustainable further development of the company and increases its future viability.

Download »

Company takeovers are a popular strategy for diversification, internationalisation and expanding market share. However, the associated risks require careful preparation, particularly with regard to the increasing relevance of ESG criteria (environmental, social and governance). These aspects not only influence the valuation and integration of a target company, but can also have financial and reputational consequences.

Download »

Family businesses that are considering a succession outside the family can increase their chances of a successful handover by taking targeted steps. Our article outlines some important measures that can help.

Download »

In the November 2024 issue of S-Firmenberatung, our ‘Handbuch zum Unternehmensverkauf’ (‘Handbook on Selling a Company’) published by NWB-Verlag is discussed.

The book is primarily aimed at entrepreneurs who are considering selling their company and want to familiarise themselves with the process and possible pitfalls.

Download »

The aim of the legal regulations is to make life easier for disabled children. Parents want to ensure this goal even beyond their own death. This is difficult to achieve without a disability will. Our paper explains what needs to be considered when drafting a disability will.

The price development of crude oil has a significant impact on the global economy, the financial markets and people's daily lives. Fluctuations in oil prices influence consumer prices and economic growth in national economies. The report looks at how price expectations can be measured and what the implications are.

The report shows the possibilities for raising equity or equity-like funds for growth financing.

Download »

When it comes to the regulation of company succession, legal and tax aspects as well as the conflicts in the generation change are frequently discussed. The financing of business succession plays only a subordinate role in the public discussion, which is surprising in view of the increasing number of business transfers to non-family successors. Our report deals with the financing aspects in connection with business successions.

The precautionary power of attorney is an essential element of any contingency planning. Now the law on guardianship has been fundamentally modernised. The focus is on strengthening the right to self-determination. The report by Dr Boris Hartisch deals with the changes to legal provisions.

Succession in a family business often triggers changes in the management structure and is regularly associated with outflows of liquidity. Particularly in the case of companies managed in the legal form of a partnership, there is no clear separation of company and private assets. The change of generation then leads to liquidity outflows if, for example, retained profits are distributed to the retiring generation or shareholder loans are repaid. Our report deals with the effects of generational change on company liquidity.

In general, groups of companies are faced with the challenge of using their capital as effectively as possible. This becomes particularly problematic if it is tied up in unprofitable or non-core parts of the business or marginal activities. Our article deals with the aspects of the sale of parts of a group.

Download »

The report addresses the question of what measures testators can take to ensure that their desired arrangements are enforced after their death. The advantages and disadvantages of various options are discussed.

Download »

A generational change in family businesses involves a variety of challenges. To make the transition successful, it is important to plan and implement the change in good time. Our report shows aspects for starting succession planning from the point of view of the successors.

Download »

Succession is one of the most important decisions for which entrepreneurs and asset owners bear responsibility. Nevertheless, the topic is usually put on the back burner. Handing over a large fortune or a company to the next generation is a complex process. The report by our advisory board member and mediator Marina von Achten presents the questions that arise and how a succession coach can provide decisive impulses so that the succession succeeds.

When a large estate is to be transferred to the next generation and passed on to several heirs, the most difficult question is often: How do I distribute fairly? Our report discusses aspects of fair wealth distribution in succession planning and alternative solutions for blocks of assets such as a company.

Download »

In our consulting work with entrepreneurial families, we are confronted with a wide variety of succession situations. Although each succession situation requires an individual solution, basic insights can be derived to make succession a success. We have summarised these in our essay.

Download »

Three-quarters of the entrepreneurs surveyed in the KfW SME Panel 2021 cite finding a suitable successor as the biggest hurdle in the succession process. In the absence of family descendants, succession can be arranged through a sale. In this case, many entrepreneurs want their life's work to be sold to the "born" buyer, who should have certain characteristics. Our article explains how this can be achieved.

Download »

The debt service providers are also undergoing a digital transformation since several years. Some innovative FinTech companies in particular have contributed to this. These service providers are increasingly relying on artificial intelligence to enter into a dialogue with the defaulting customer.

Download »

Our report deals with the options of credit institutions and leasing companies in the management of non-performing loans (NPL). By transferring NPLs to a collection service provider, higher proceeds from the realisation of NPL loans can often be achieved.

Download »

A sales process is both an endurance run and a sprint. For entrepreneurs, the sale of the company is usually a one-time affair. There is no experience of how a transaction is conducted. This report shows the typical tasks that a company seller faces in the course of the sales process.

Download »

In this report we have summarised our experience in advising on business succession in nine theses.

By planning asset and business succession in good time and with foresight, inheritance disputes can be avoided and assets divided fairly among the descendants.

Download »

Every family is faced with the question of how to transfer assets to the next generation. If the testators do not make any arrangements, the legal succession applies: the heirs receive a proportionate claim to each individual asset; a community of heirs is created. If this is not desired, a will or contract of inheritance is required.

The report shows typical weaknesses in the asset structures of entrepreneurial families and gives advice on how to optimise them. An executor can take on important tasks in the settlement of the estate, suggest creative solutions and exert an influence on the heirs that avoids disputes.

Download »

Companies present themselves constantly: On the internet with their own homepage, in social media or in company brochures. If a company is to be sold, it is important to consider how the company is presented to potential buyers.

Download »

The term acquisition financing is understood in the broadest sense to mean the raising of debt financing for the purchase of a company. The range of instruments used in connection with the financing of a company acquisition extends from so-called senior loans to unitranche loans, mezzanine loans, and shareholder and vendor loans. The paper provides an overview of the financing instruments.

Download »

There are no "winners" in family disputes. Conflicts in business succession can destroy relationships for generations. Litigation is also costly. Therefore, this path should be the last resort. Here, mediation can lead to consensus and thus success through the structured procedure and the use of a neutral "third party". The report presents the process of mediation and the development of possible solutions.

Download »

More than two thirds of Germans do not leave a will and thus rely on the legal regulations. The goal of a fair and dispute-free succession of assets is thus often missed. An executor, who takes over the distribution and administration of the estate in the spirit of the testator, can make a significant contribution to avoiding disputes.

For entrepreneurial families, the arrangement of an executor is a good idea if the heirs are not in a position to handle the inheritance or administer the estate, e.g. in the case of minor heirs. Our report deals with the execution of wills.

Download »

Interlocutors of entrepreneurs often use the slogan "Use crises as opportunities". In this context, it is surprising that there are many entrepreneurs who see future opportunities in the current crisis situation. Responding flexibly to current developments and adapting the business model quickly has always been an important skill for entrepreneurs, and one that has gained enormous importance in the Corona crisis. The instruments for crisis management have never been as diverse and promising as they are today. The global networking made possible by the Internet and other technological developments allows international cooperation on an unprecedented scale. We are witnessing the creativity with which companies are preparing for the future - also by buying other companies to strengthen their competencies. Others are taking on equity partners whose capital, networks and know-how will enable them to meet future challenges. The report provides arguments why our economy will emerge stronger from the Corona crisis.

Download »

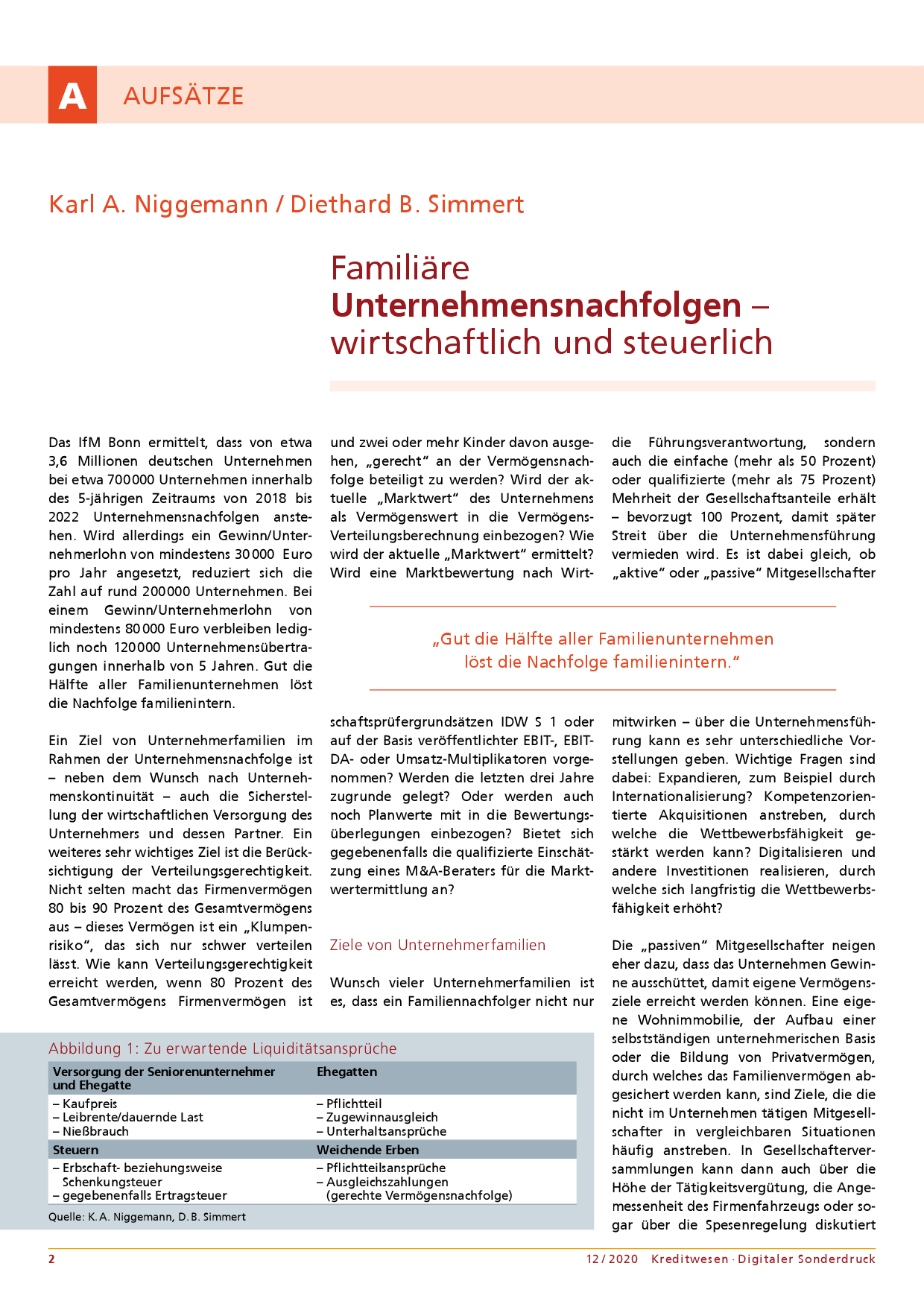

One goal of entrepreneurial families in the context of business succession - in addition to the desire for business continuity - is also to ensure the economic provision of the entrepreneur and his or her partner. Another very important goal is the consideration of distributive justice. If a business succession is planned, it makes sense to gain an overview through a careful economic analysis. This article deals with both the economic and tax aspects and liquidity implications that need to be considered.

Download »

So-called "warranty & indemnity insurance" (W&I insurance) is being used more and more frequently in M&A transactions. With this insurance, liability risks from guarantees ("warranties") and indemnities ("indemnities") to be issued are assumed by an insurer in return for a premium. Our article deals with the aspects of taking out a W&I insurance policy.

Download »